Zoho Books Training by Experts

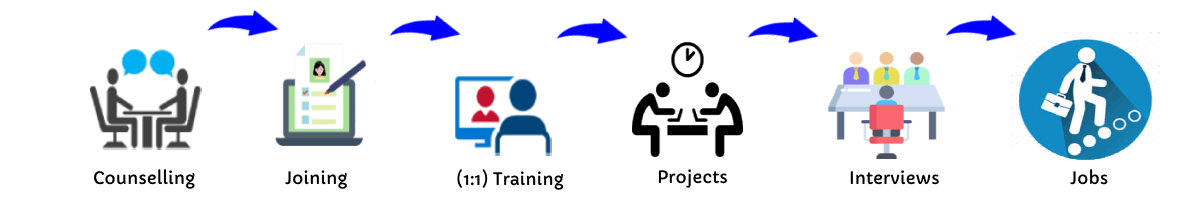

Our Training Process

Zoho Books - Syllabus, Fees & Duration

Zoho Books Course Syllabus – Nestsoft Technomaster

Module 1: Introduction to Zoho Books

- Overview of Zoho Books – Features and Benefits

- Understanding Cloud Accounting and Automation

- Zoho Books Dashboard and Navigation

- Setting Up a New Organization in Zoho Books

- User Roles and Permissions Management

Module 2: Setting Up Accounting and Financial Preferences

- Configuring Company Details and Fiscal Year

- Chart of Accounts – Creating and Managing Accounts

- Multi-Currency Setup and Foreign Exchange Transactions

- Customizing Invoice and Document Templates

- Setting Up Taxes – GST, VAT, and Other Tax Rules

Module 3: Managing Sales and Receivables

- Creating and Customizing Invoices

- Sending Quotes and Estimates to Clients

- Recording Customer Payments and Refunds

- Automating Recurring Invoices and Payment Reminders

- Managing Sales Orders and Credit Notes

Module 4: Managing Purchases and Payables

- Creating and Tracking Purchase Orders

- Recording Bills and Vendor Payments

- Handling Expenses and Reimbursements

- Recurring Bills and Auto-Pay Setup

- Managing Vendor Credits

Module 5: Bank Reconciliation and Cash Flow Management

- Connecting Bank Accounts and Importing Transactions

- Automating Bank Feeds and Transaction Matching

- Reconciling Accounts and Fixing Discrepancies

- Managing Petty Cash and Cash Flow Forecasting

Module 6: Taxation and Compliance (GST, VAT, TDS, etc.)

- Understanding Taxation in Zoho Books

- Setting Up GST and VAT Tax Rates

- Generating Tax Reports and Filing GST Returns

- Withholding Tax (TDS) Configuration and Reporting

- Audit Trail and Compliance Management

Module 7: Inventory Management and Stock Control

- Enabling and Configuring Inventory in Zoho Books

- Adding Products, SKUs, and Pricing

- Tracking Stock Levels and Stock Adjustments

- Managing Warehouses and Multi-Location Inventory

- Generating Inventory Valuation and Stock Reports

Module 8: Reports and Financial Analysis

- Generating Profit and Loss Statements

- Balance Sheet and Trial Balance Overview

- Cash Flow and Revenue Forecasting

- Customizing and Automating Reports

- Exporting and Sharing Financial Reports

Module 9: Integrating Zoho Books with Other Zoho Apps

- Connecting Zoho CRM, Zoho Inventory and Zoho Payroll

- Automating Workflows using Zoho Flow

- Third-party Integrations (Stripe, PayPal, Razorpay, etc.)

- API and Customization for Advanced Users

Module 10: Automation and Advanced Features

- Setting Up Workflows and Automating Transactions

- Using Client Portal for Customer Communication

- Managing Subscription Billing and Retainers

- Handling Multi-Currency Transactions and International Business

Hands-on Projects and Real-Time Scenarios

- Setting Up and Managing a Business in Zoho Books

- Automating Invoice and Payment Processing

- Handling GST Compliance and Tax Filing

- Creating Custom Reports and Dashboards

- Integrating Zoho Books with Zoho CRM for Sales and Accounting Sync

This syllabus is not final and can be customized as per needs/updates

By the end of this course, you will be equipped with the expertise needed to handle financial transactions, streamline business operations, and optimize accounting processes with Zoho Books. For professionals looking to automate their business processes, the course covers workflow automation, recurring transactions, and API-based customizations. Additionally, the course delves into financial reporting, where learners generate profit and loss statements, balance sheets, and revenue forecasts. Join Technomaster’s Zoho Books training today and take your accounting skills to the next level! 🚀. Whether you're a business owner, accountant, freelancer, or student, this course will empower you with the necessary skills to efficiently manage finances using Zoho Books. The training also includes Zoho Books integrations, demonstrating how to connect with Zoho CRM, Zoho Inventory, payment gateways, and other third-party applications. The training is designed to be flexible, offering live online sessions, interactive Q&A, and hands-on practice to ensure a seamless learning experience. Participants will learn how to set up an organization, configure financial preferences, and manage user roles and permissions. A key highlight of this course is bank reconciliation, where students will learn to integrate bank accounts, import transactions, automate feeds, and maintain accurate financial records. Moving forward, the training covers sales and receivables, including invoicing, estimates, payment tracking, and credit notes.

By the end of this course, you will be equipped with the expertise needed to handle financial transactions, streamline business operations, and optimize accounting processes with Zoho Books. For professionals looking to automate their business processes, the course covers workflow automation, recurring transactions, and API-based customizations. Additionally, the course delves into financial reporting, where learners generate profit and loss statements, balance sheets, and revenue forecasts. Join Technomaster’s Zoho Books training today and take your accounting skills to the next level! 🚀. Whether you're a business owner, accountant, freelancer, or student, this course will empower you with the necessary skills to efficiently manage finances using Zoho Books. The training also includes Zoho Books integrations, demonstrating how to connect with Zoho CRM, Zoho Inventory, payment gateways, and other third-party applications. The training is designed to be flexible, offering live online sessions, interactive Q&A, and hands-on practice to ensure a seamless learning experience. Participants will learn how to set up an organization, configure financial preferences, and manage user roles and permissions. A key highlight of this course is bank reconciliation, where students will learn to integrate bank accounts, import transactions, automate feeds, and maintain accurate financial records. Moving forward, the training covers sales and receivables, including invoicing, estimates, payment tracking, and credit notes.